Press Release

Latest News

- Gulf Mercantile Exchange Wins 'Middle East Exchange of the Year' Award

- GME and Fastmarkets forge strategic partnership to innovate commodity risk management tools in the region

- GME Reports Strong Performance in 2024

- Dubai Mercantile Exchange Rebrands to Gulf Mercantile Exchange, Ushering in a New Era of Trading Excellence

- Dubai Mercantile Exchange announces name change to Gulf Mercantile Exchange following strategic partnership with Saudi Tadawul Group

Posted on Dec 25, 2019.

DME Oman to Price Kuwaiti Crude Oil from February 2020

DME Oman to Price Kuwaiti Crude Oil from February 2020

The move reinforces DME’s position as a key benchmark for Gulf crude oil

Dubai, UAE – 25 December 2019: Dubai Mercantile Exchange (DME), the premier international energy futures exchange in the Middle East, today announced that Kuwait Petroleum Corporation (KPC) will use the DME Oman Futures contract as a price reference for Kuwaiti crude oil exports to Asia from 1 February 2020 onwards.

The decision by KPC reinforces DME Oman’s benchmark status in the Middle East. DME Oman is widely regarded as the most efficient and transparent price discovery and risk management tool for the regional sour crude oil market. Oman Blend crude oil is highly representative of the quality of the majority of Middle Eastern crudes and as such is an ideal price marker for the region’s oil exports.

Raid Al-Salami, DME Managing Director, said: “The combination of Oman’s historical role as a trusted benchmark with best-in-class technology, market regulation and physical delivery makes DME Oman a very compelling benchmark for national oil companies that want transparent price discovery for their crude oil exports.”

“We welcome KPC and are delighted by their decision to switch part of their formula to DME Oman. We highly value the trust and the confidence granted to us by KPC and we are committed to providing the region with reliable risk management and price benchmarks,” Al-Salami added.

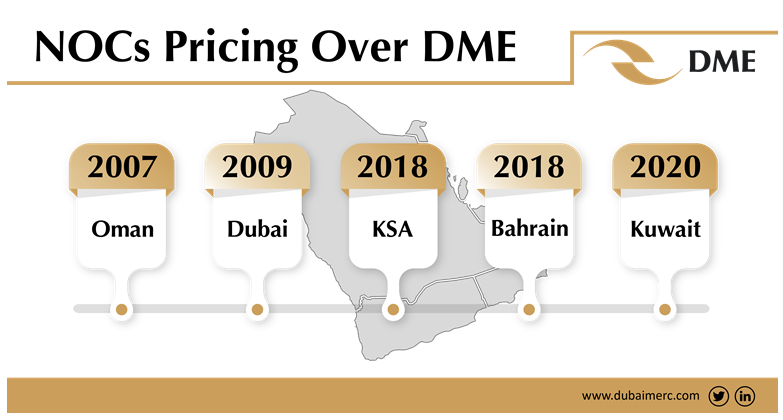

DME Oman crude oil futures contract is an official benchmark for five producers in the Middle East, all of whom use the exchange’s marker price in their crude oil export contracts with Asian customers. The five producers are Oman, Dubai, Saudi Arabia, Bahrain and now Kuwait.

Latest News

Have a question?

Reach out to the CME Global Command Center for trade related customer

support:

Asia: +65 6532 5010 |

Europe: +44 800 898 013 |

North America: +1 800 438 8616